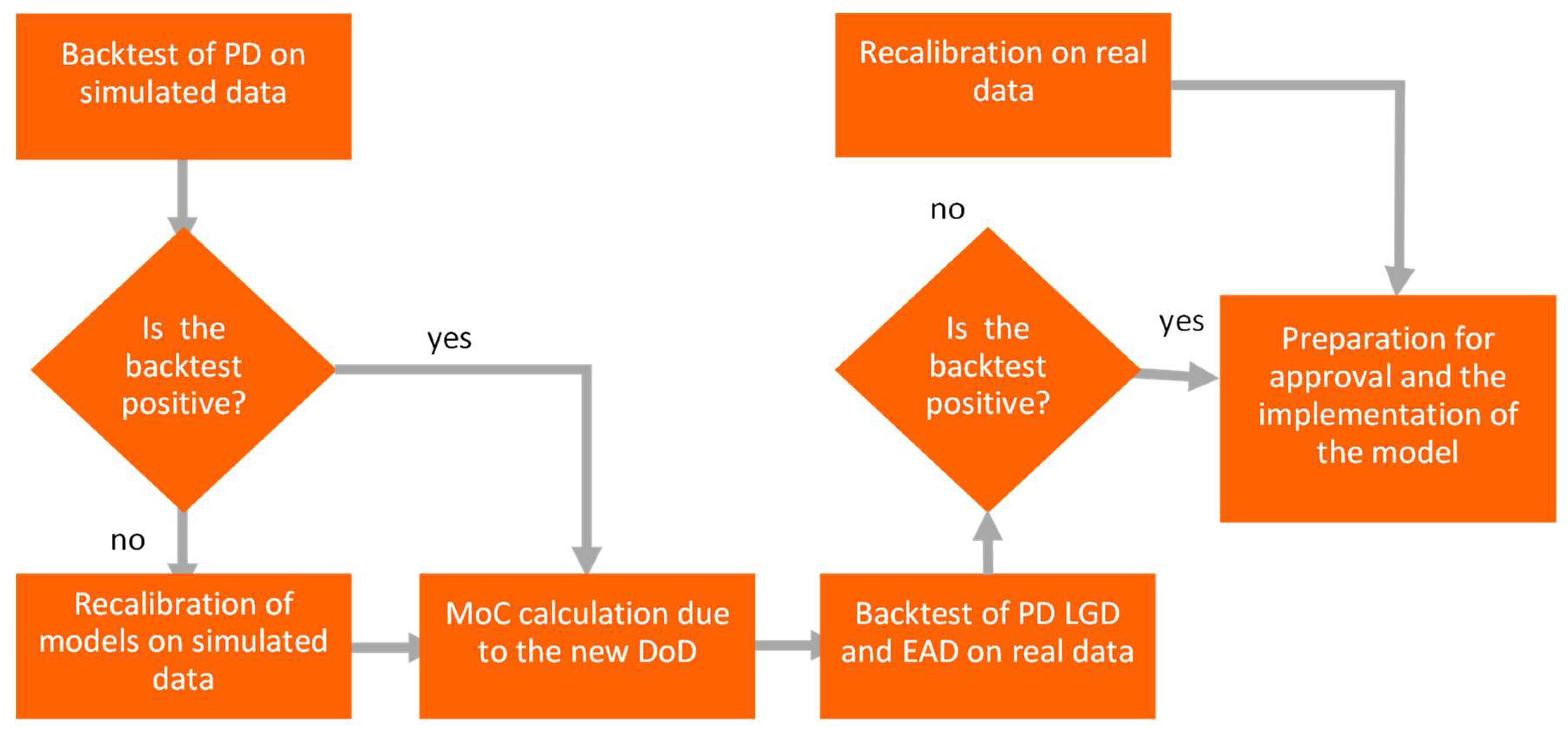

Risks | Free Full-Text | New Definition of Default—Recalibration of Credit Risk Models Using Bayesian Approach

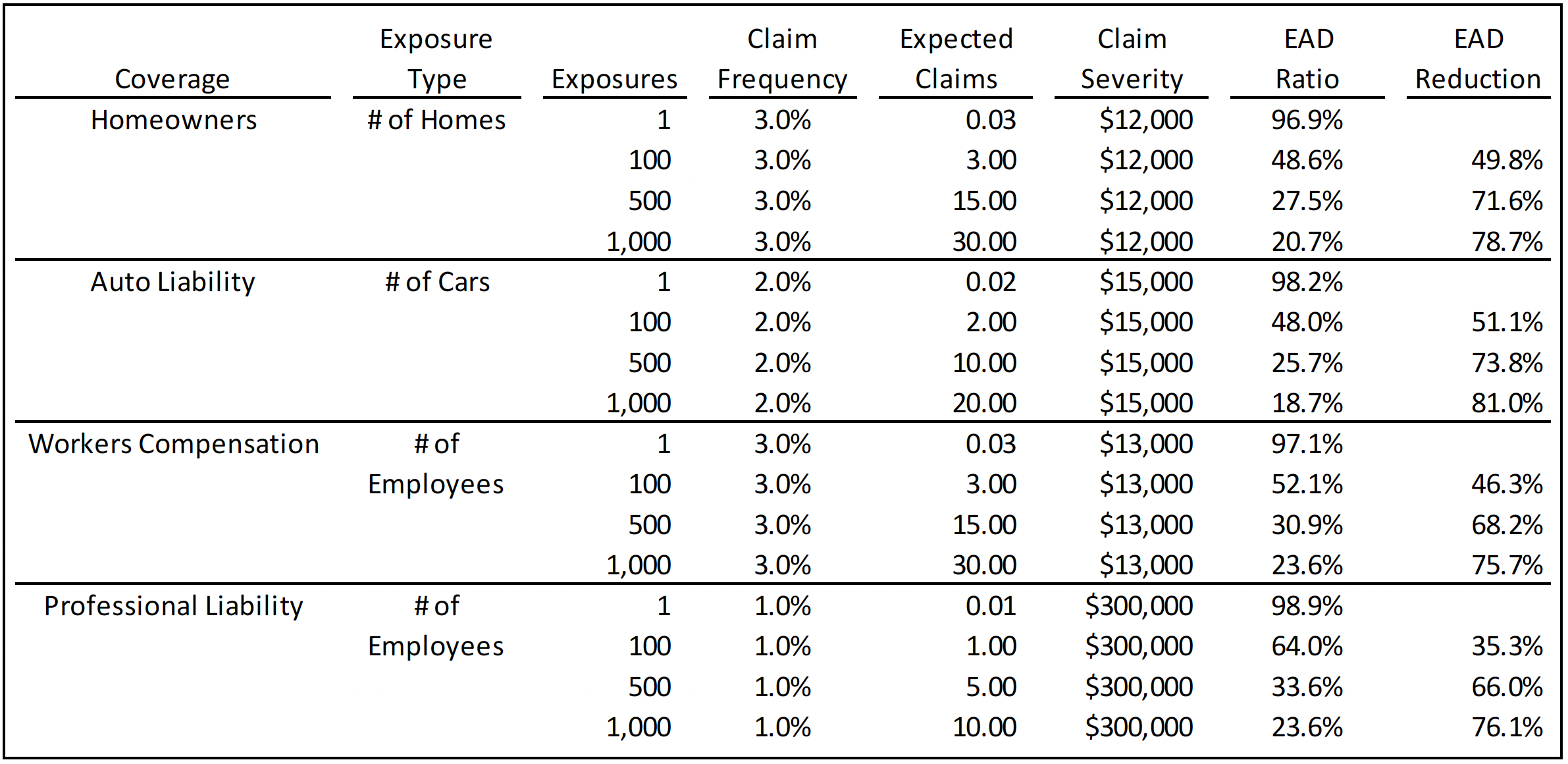

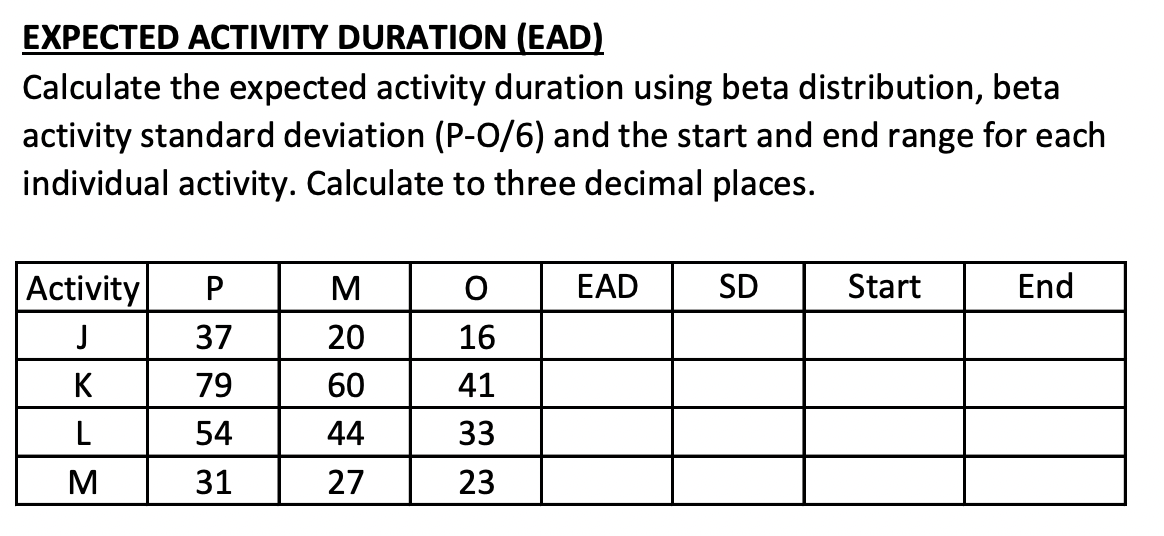

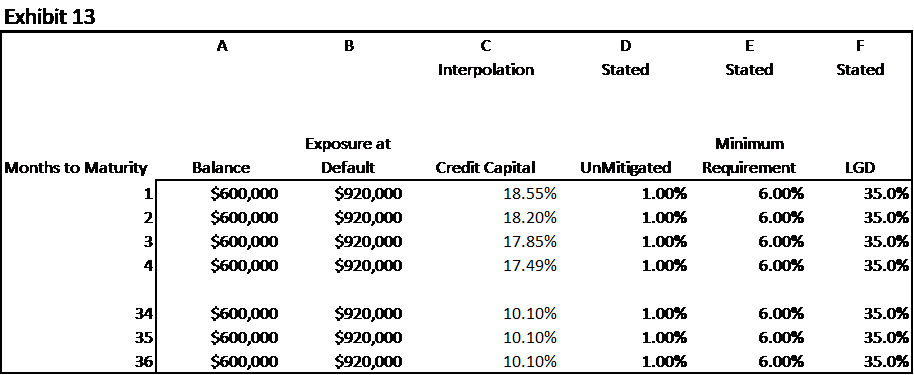

Schematic illustrating the calculation of EAD for baseline (blue) and... | Download Scientific Diagram

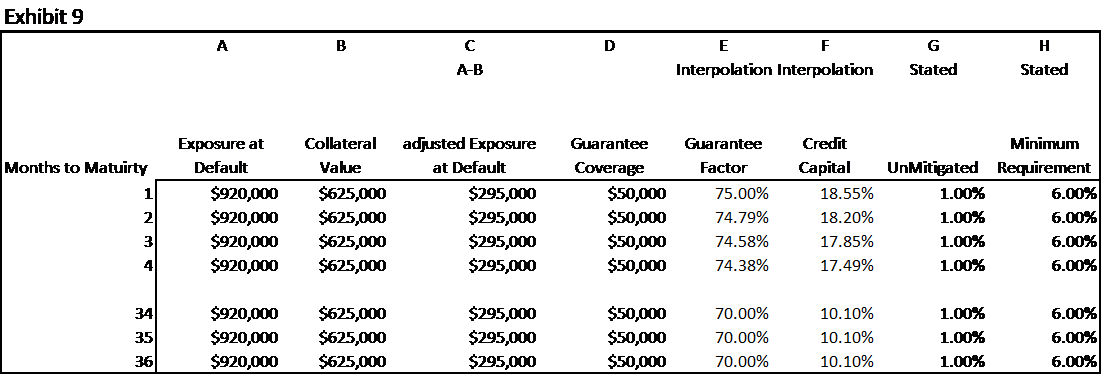

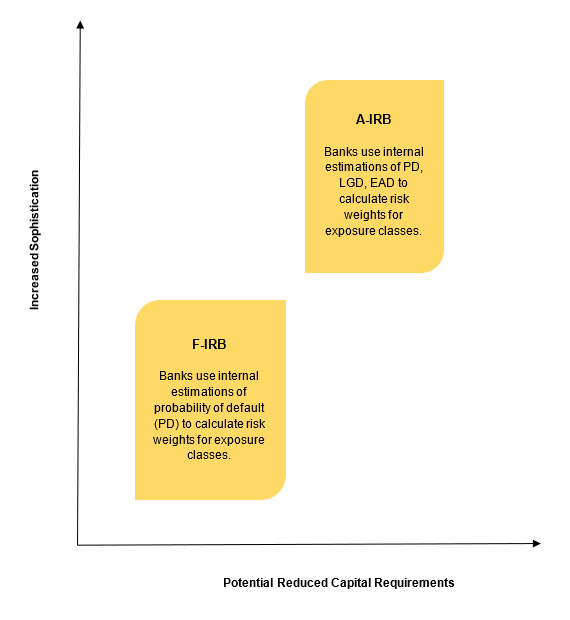

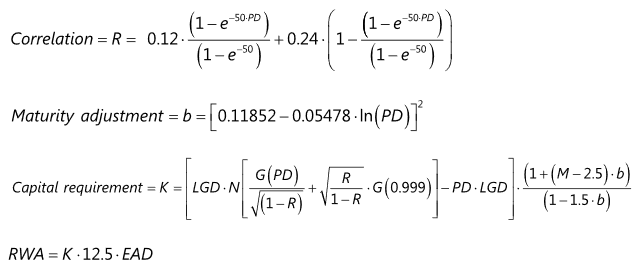

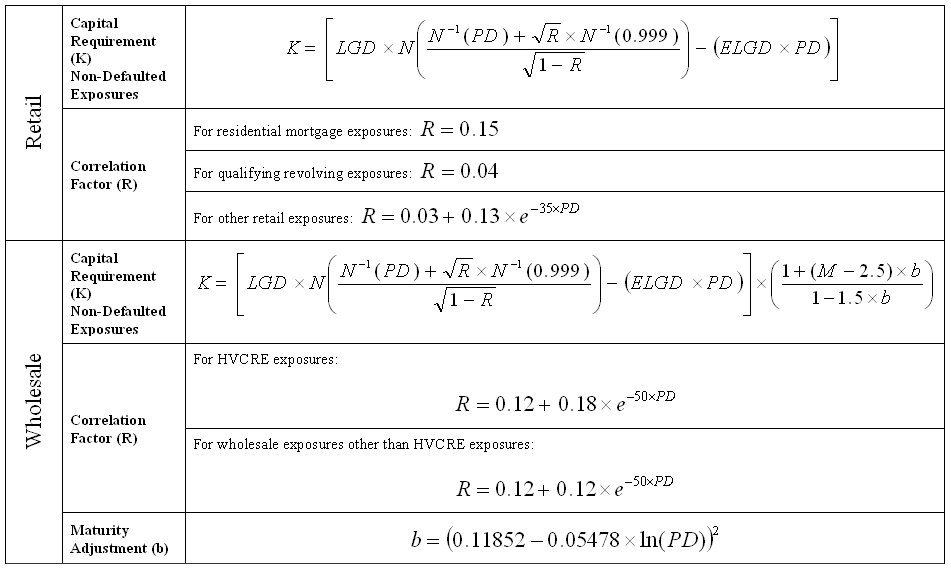

Basel II Capital Accord - Notice of proposed rulemaking (NPR) - Proposed Regulatory Text - Part IV - Risk-Weighted Assets for General Credit Risk